Back

27 Feb 2020

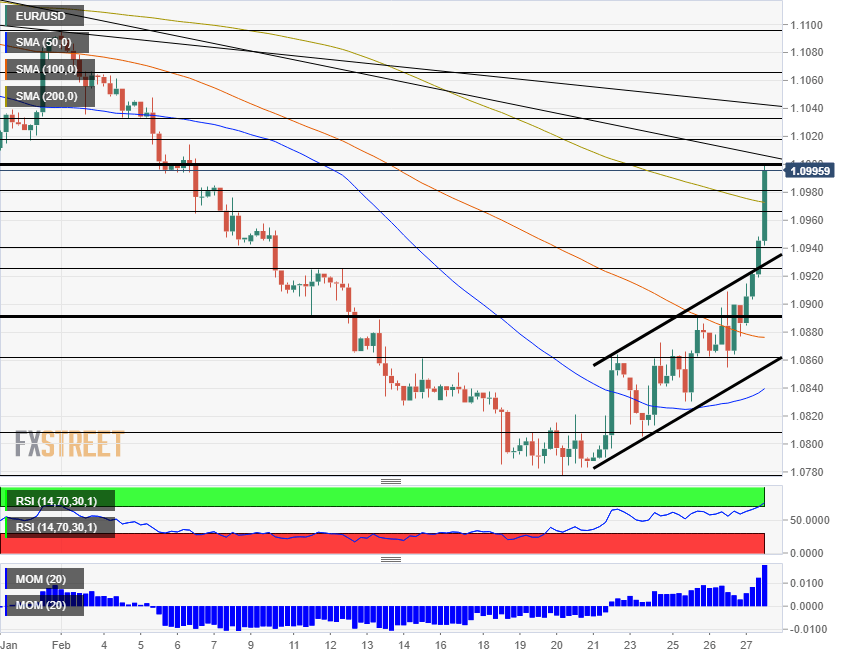

Breaking: EUR/USD breaks above 1.10 on coronavirus-linked USD weakness

EUR/USD has hit the highest levels in three weeks, trading at 1.10 and completing a remarkable V-shaped recovery.

Coronavirus has sent stock markets crashing and traders are flocking to safe-haven US bonds. In turn, lower yields are pricing in rate cuts by the Federal Reserve – even as soon as the March meeting.

The common currency is also benefiting from hopes that Germany unleashes fiscal stimulus to face the economic slowdown that began before the disease scare.

-- more to come