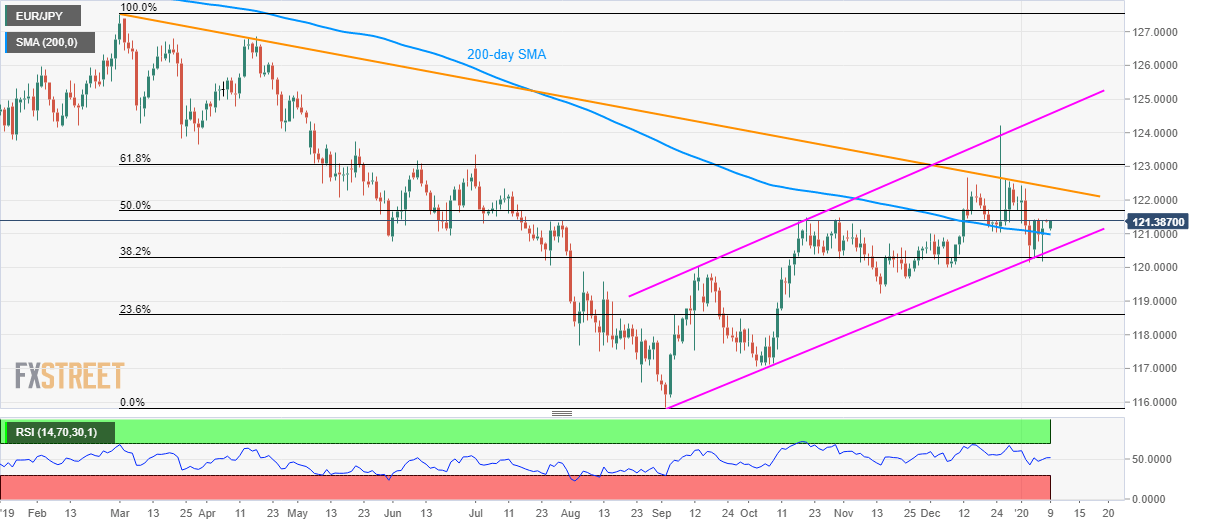

EUR/JPY Technical Analysis: On the recovery mode inside multi-week-old rising channel

- EUR/JPY holds on to recovery gains after bouncing off the three-month-old ascending trend channel’s support.

- 50% Fibonacci retracement, a descending trend line since March on buyers’ radar.

- 200-day SMA offers immediate support.

EUR/JPY takes the bids to 121.39 during Thursday’s Asian session. In doing so, the pair extends its recovery from a multi-week-old bullish chart pattern.

With this, buyers are gearing up for 50% Fibonacci retracement of March-September fall, at 121.70 whereas a nine-month-old descending trend line, at 122.38, could question the bulls afterward.

In a case where buyers manage to dominate past-122.38, 61.8% Fibonacci retracement and the resistance line of the aforementioned channel, near 123.07 and 124.55 respectively, will cap the pair’s further advances.

Meanwhile, a 200-day SMA level of 120.98 acts as immediate support for the pair ahead of the channel’s lower-line, around 120.49 now.

If at all sellers defy the bullish chart formation, 120.00 and mid-November low near 119.24 will be on their watch-list.

EUR/JPY daily chart

Trend: Bullish